This article explores the surprising connection between digital assets, a new and volatile investment class, and life insurance, a traditional and secure financial product.

The Challenge: Balancing Risk and Regulation

Digital assets, while exciting, are unregulated and speculative. PPLI, on the other hand, offers stability and protection. So, how can they work together?

The Solution: Secure Holding

Bespoke life insurance products, called Private Placement Life Insurance (PPLI), allow you to invest in digital assets within a regulated structure. This simplifies ownership, reporting, taxes, and inheritance.

PPLI Explained

PPLI is a contract between an individual/legal entity and a Financial Institution which is regulated as an Insurance Company

It involves transferring ownership of your assets to the Insurance company while staying in control of how the assets are managed, invested and benefits are distributed during your lifetime and to your chosen beneficiaries in case of death

Beyond the succession planning element, it confers a level of confidentiality, assets protection, tax efficiencies, for your wealth that may not be available with individually held assets or assets held under different structure.

PPLI Benefits

PPLI, depending on your location, can offer:

Regulation: A Work in Progress

Regulations for digital assets within life insurance are still evolving. However, existing insurance regulations provide some guidance.

The Future of Regulation

Recent events have highlighted the need for stricter regulations around digital assets. Upcoming regulations like MICA in the EU and SEC approvals in the US aim to protect investors and promote a healthy digital asset market.

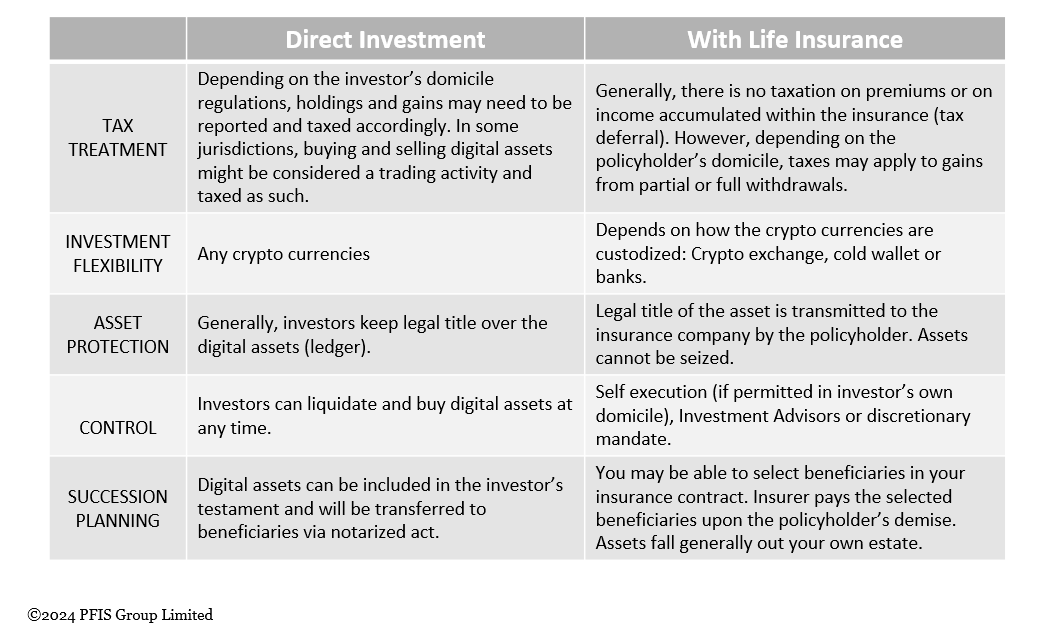

Combining Digital Assets and Life Insurance: Weighing the Options

The benefits of this approach depend on your location and the specific PPLI product. Consulting a licensed advisor as we are, is recommended before making any decisions.

Conclusion:

Digital assets and life insurance, despite their differences, can offer a compelling combination for investors seeking both innovation and security.